Payroll Matching Statement Explaining the Difference

In addition the retailer incurred payroll taxes. Etymology 1 From.

All Sizes Resume Design For Student Resume Flickr Photo Sharing Resume Design Unique Resume Design Resume Examples

Payroll Register different to Activity Summary.

. Im having the same issue - the normal matching function isnt matching for several payroll items in January 2021. The total amount of money that a company pays to its employees a companys records of its employees salaries and wages bonuses and withheld taxes. Payroll is the function of a business paying its employees.

They are usually paired up against revenue via the matching principle. You also have to be careful and make sure that there is nothing. Hope that HO refunds.

With 24 pay periods in a year your gross pay is 5000 per pay period. It all depends on the case worker how they take it. The department in a company responsible for it.

This statement is issued with particulars like employee id bank account number amount of wages etc. Answer 1 of 15. At the same time as the revenues.

Every Payroll Suppose your employer matches dollar for dollar on the first 4 of pay and your pay is 120000 per year. En noun A list of employees who receive salary or wages together with the amounts due to each. The third consists of payroll taxes owed to the respective governmental.

Once you complete payroll you need to ensure that companys bank account has sufficient funds to make the salary payment. The first is the amount of payroll earned by staff and not yet processed or paid. The total sum of money paid to employees.

Over the course of a year your employer will match 4800. Click on the Gear button then on Tools and then Reconcile. If u still have leave then you can re apply.

As verbs the difference between statement and explaining is that statement is to provide an official document of a proposition especially in the uk a statement of special educational needs while explaining is. When matching the bank statement the payroll journal should be matched not created. If the employer is matching on a quarterly basis which is not per payroll period they should be using the end of year or true-up for the timing of when the match contribution is made.

Finance A document that summarizes financial activity. The matching principle is an accounting concept that dictates that companies report expenses. For example if you have a 401k deduction that should reduce both federal and state income tax but it does not reduce state taxable wages set up wrong then the boxes will differ.

If you are creating a payroll journal it is an indication your payrun is incomplete. If normally they are the same for you and they are not this year look for payroll items that should impact taxes wages but do not. If you have set up any new payroll deductions this year that is.

Means i a written statement setting forth the monthly quarterly and annual as applicable payroll at the Facility and the amount of wages paid to each full-timeemployee at the Facility and ii such other documentation as reasonably determined to be necessary by the WFEDC to verify the number of New Positions created and continuing. It also includes keeping records on those payments and paying taxes on behalf of those employees. Payroll Run in JCurve Preferred Method of Payment.

Along with the amounts that each employee should receive for time worked or tasks performed payroll can also refer to a companys records of payments that were previously. Match transactions to your bank statement and check them off one by one. A presentation of opinion or position.

If you contribute 200 per pay which is 4 of 5000 your employer matches another 200. From making complex calculations to processing payments within strict deadlines this is a challenging demanding and fulfilling role. A payroll administrator like accountants hold a crucial role within every organisation.

The amount of the wages for the five days of December 27 through December 31 are calculated to be 5000. Accrued Expenses Accrued expenses are expenses that are recognized even though cash has not been paid. Then you need to send a salary bank advice statement to the concerned branch.

Since youve determined the Payroll. End of the year check stubs will show the total or gross earnings that an employee received. Their job involves handling large sums of money on a daily basis to ensure that employees are paid accurately and on time.

Payroll is used at the end of the fiscal year to assess annual employee wages. Accrued payroll is a current liability composed of four sections. If the plan document says the match is to be madecalculated each payroll period the match must be made each payroll.

1 It includes distributing money in the form of checks and direct deposits. Accrued Payroll An Explanation. A payroll is a companys list of its employees but the term is commonly used to refer to.

Noun A declaration or remark. The quickest explanation for this difference is that the last pay stub and W-2 form will almost always show two different wages. Computing The series of accounting transactions that ensure that employees are paid correctly and that all taxes etc are properly deducted.

Click on the drop-down menu under Accounts and select the account you want to reconcile. The truth is that unless there have been no deductions taken from a paycheck an employees last pay stub and W-2 form will almost never match. If HO sees this as a minor difference they will discretely grant leave to remain.

Not only is it a single step solution it avoids. Hi AGreg The Payroll Activity reports gets information from individual pay runs while the Payroll Register reports feed from the pay history in employee cards which can be manually edited resulting a difference between Activity and Register reports. If they return your application you may have right to appeal if your current leave has expired.

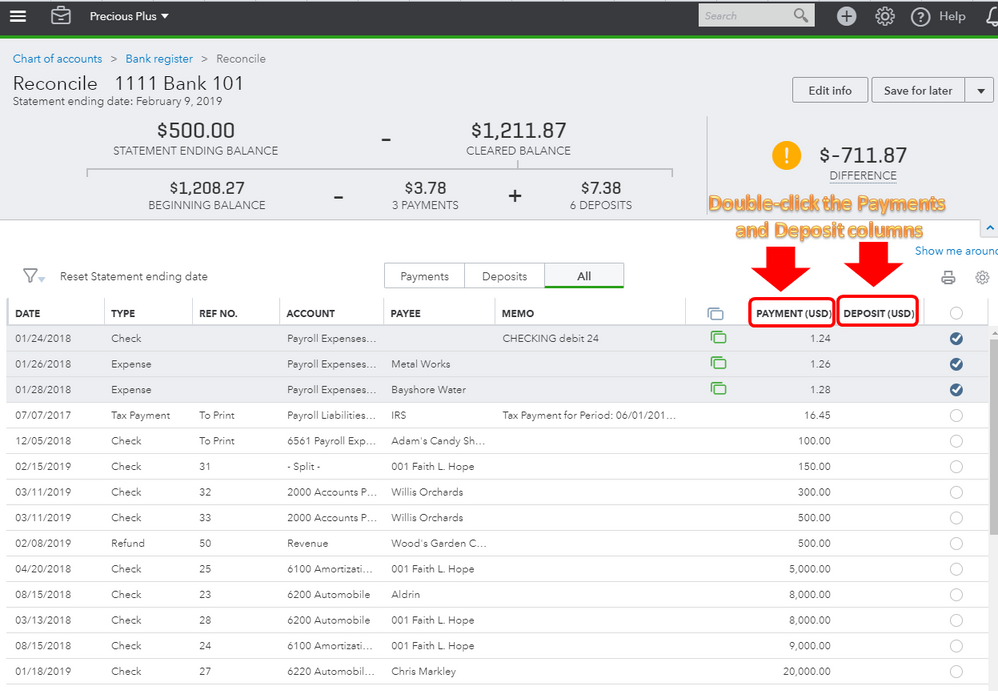

If you are opting for a payroll software. This is clearly a QBO glitch that needs to be fixed by QBO - the normal find match or auto-match functions both arent working properly even with checks or payroll transactions that meet the normal criteria proper date exact amount proper bank. Enter the Ending balance and Ending date based on your bank statement information.

If HO wants to know why there is a difference in figures they will contact you. Lets also assume that as of December 31 the hours worked from December 27 through December 31 will be part of the payroll that will be processed in early January and paid to the employees on Friday January 8. In treasury management a payroll is the list of employees of some company that is entitled to receive payments as well as other work benefits and the amounts that each should receive.

The second is the dollar value of personal time off accumulated for each employee aggregated into one number. Write a statement explaining the difference between an intercept and a point of from ALG 1 A1 at Jefferson County High School Louisville. Use a single ABA file and load this file to the bank when paying the payrun select all employees to be paid at once.

If the company violates the matching principle by ignoring the bonus expense throughout the year 2021 when sales actually occurred and reports the entire bonus amount as an expense for just one day January 15 2022 every income statement pertinent to 2021 will report too much net income and the income statement that includes January 15 2022 will report too little net.

Dropcatch Com First Job Job Advice Job

Excel If Statements Part 3 Nested If Statements Learn Excel Now In 2021 Excel Syntax Nest

Completing Accounting Cycle In 5 Steps Reporting And Auditing Accounting Cycle Accounting Accounting Student

3 Main Types Of Resume Formats Jobcluster Com Blog Resume Writing Format Resume Format Best Resume Format

Explainer How Does Employer 401 K Matching Work Ellevest

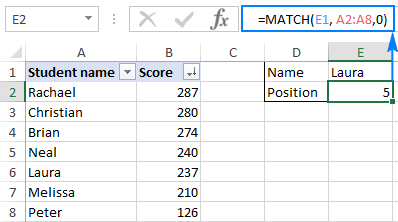

Excel Match Function With Formula Examples

Do You Know The Difference Between Salary Total Compensation Well You Should Because Understanding Pay In 2022 Understanding Understanding Yourself Compensation

Fake Hospital Discharge Forms Best Of Top 40 Trust Printable Fake Hospital Discharge Papers Doctors Note Template Doctors Note Student Resume Template

What Are Employer Taxes And Employee Taxes Gusto

Social Skills Social Skills Activities Consequences Life Skills Social Skills Activities Social Skills Skills Activities

Matching Principle Understanding How Matching Principle Works

Welding Resumes Examples Job Resume Examples Resume Objective Examples Cover Letter For Resume

Household Budget Template Weekly Budget Template Budget Template

Negotiations In Business Sample Cases For Discussion Negotiation Negotiation Skills Teaching Jobs

Solved Reconciliation Discrepancy

Curriculum Vitae Or Resume They Are Not The Same Resume Power Words Part Time Teaching Jobs Curriculum

Roth 401 K Vs 401 K How To Decide Which Plan Is Best For You

Comments

Post a Comment